interest rate varies with the investment term.

Pure expectation theory:

view a sequence of short term bonds as a perfect substitute for a single longterm bond.

Liquidity preference theory:

invest money for a sequence of short period so that the money is frequently accessible.

issuers must offer long-term-bonds with higher rates, called liquidity premium

Preferred habitat theory:

Market segmentation theory:

not one market, divided into separate market for each term.

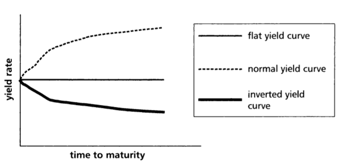

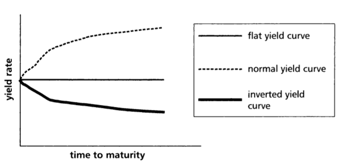

Yield curve to see one’s annual yield rate.

spot rate / zero-coupon rate is the annual effective interest rate earned by money invested at time 0 for a period of t years.

Treasury bills, matures of one year or less, zero coupon bonds, semiannual coupons.

K$ invested at time 0 grows to at time t.

if , investment grows to at time s.

The annual effective interest rate foe the interval is , such that

the theoretical forward rate / implied forward rate.

Assumption: compound interest, spot rate are all equal, if one spot rate changes, all change to remain a equal spot rate(parallel shifts).

Present Value

when , modified duration