bonds: government issued,

last payment occurs at maturity date / redemption date

purchase date is called issue date,

term: intervel

maturity date is fixed, then the bond is noncallable,

a single payment at a fixed maturity date, it is called zero-coupon bonds / (pure) discount bonds

a sequence of payment prior to and at the redemption date coupon bonds, as well as an redemption payment additionally.

length of the interval between coupon payments is coupon period, usually semiannual , half a year;

indenture is the legal document that specifies the term and conditions of a particular bond;

Face value / Par value , calculate the size of the coupon payments, not the price investor pay, not the redemption value of the bond at maturity.

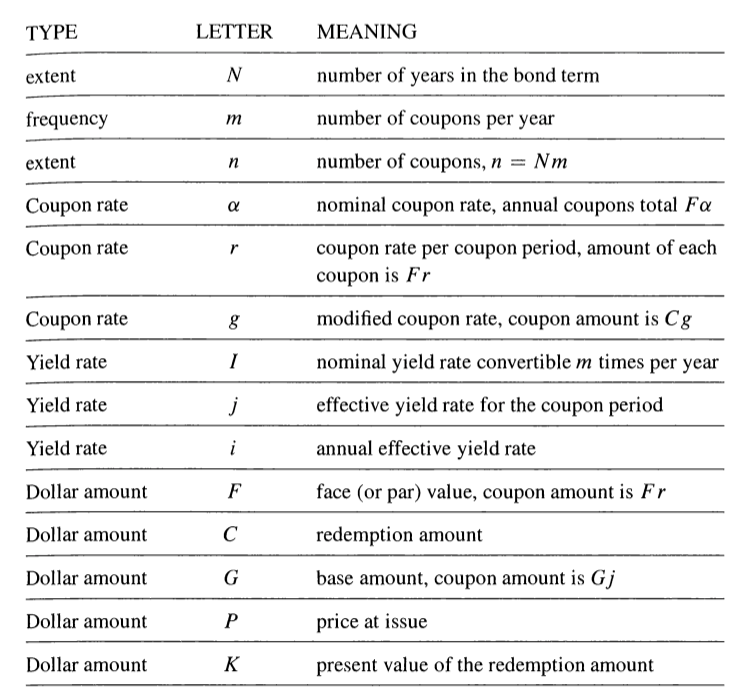

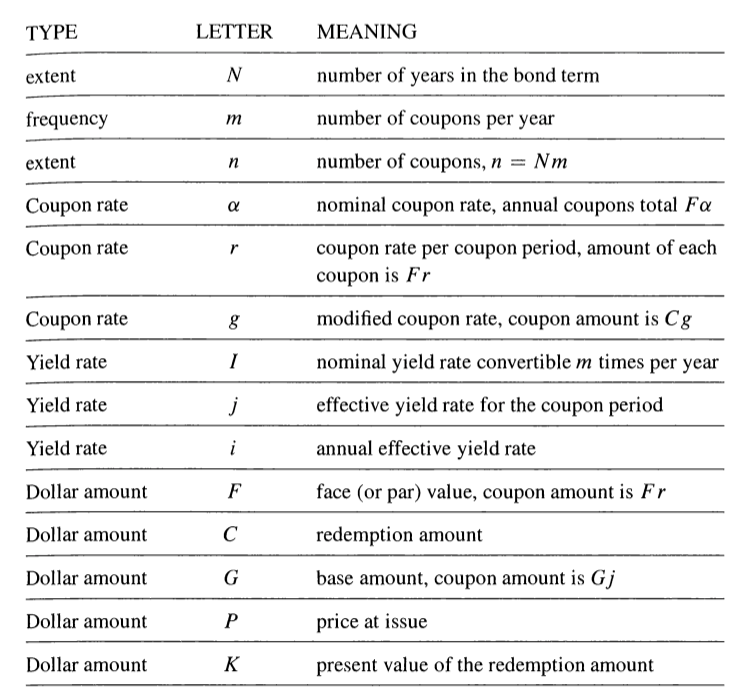

, the nominal rate convertible times per year, is the number of coupons each year.

Set , r is the effective rate for the coupon period.

both and r are sometimes called Coupon Rates.

Amount of each payment is .

let denoted the numbers of coupon periods in the term of the bond. if it is an N- year bond, .

id the redemption amount , the bond holder receives at the bonds maturity date, excluding the regular coupon amount.

If , the bond is said to be a par value bond / redeemable at particular.

if no redemption amount is specified, assume the bond is a par-value bond.

Modified Coupon Rate .

Annual effective yield rate , investor’s effective yield rate per coupon period , and , usually, the yield rate is specifies as a nominal rate , convertible times per year, , and

Base Amount is the amount you need to invest now, at interest , to create a perpetuity paying an amount of interest at the end of each coupon period that is equal to the coupon amount. expresses the coupon amount in terms of the yield rate per coupon period . .

The amount of each coupon payment is .

Price paid for the bond to yield the investor per interest period, .

Set , the value of the redemption at the issue date figured using compound interest and the yield rate received by th e investor.

.

Premium-discount pricing formula

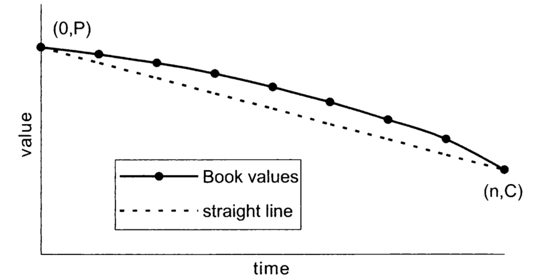

Sell at a premuim if the price is greater than the redemption value , premium / amount of premium , .

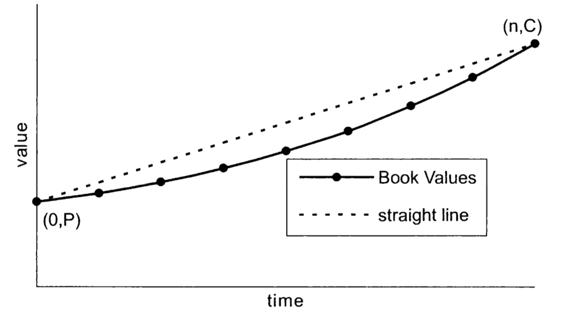

Sell at a discount if the price is less than the redemption value , discount / amount of discount , .

Premium

Discount

From the base amount formula we can get:

a

Makeham’s Formula:

The applicable interest rate for each interest period is .

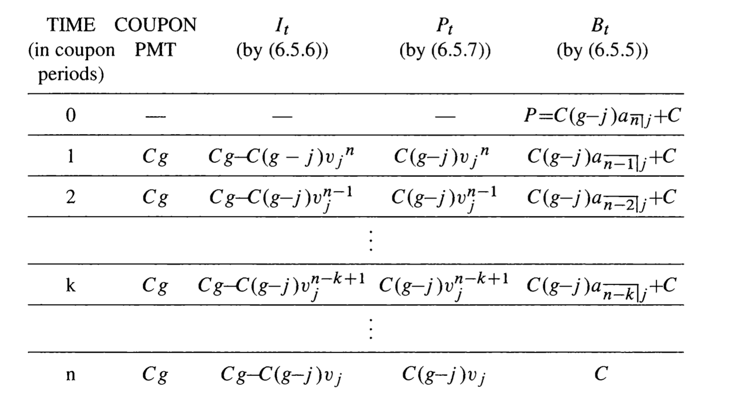

Set book value the balance of the debt at time t, immediately after any time t coupon payment, before redemption payment.

, and

interest due at time t,

amount for adjustment of principal

Value with respect of interest rate (effective yield rate per coupon period) price paid for the bond;

dirty value/ theoroetical dirty value: .

discountinue

clean value continues function.

single call date prior to maturity;

wait until the date;

Multiple specified date, coincide with coupon dates;

wait until certain day;

Callable at any time following the lockout period.

any day